I am, by no means, easily suckered in by phone calls claiming I’ve won money, qualified for a loan, or had my personal info hacked. But I’ve recently been receiving phone calls claiming to be from my bank. And they’re EXTREMELY convincing. Here’s how it goes:

It starts with the caller I.D. The call displays the name of my actual bank or their fraud department number. It spoofs the actual number shown on the back of my debit/credit card. The caller introduces themselves as part of the fraud team from my bank (They actually know my bank and my name). There’s been some suspicious activity on my account, they say, and they’d like to know if I just made a large purchase on Amazon (Who doesn’t use Amazon?) and another purchase shipping to a location out of the country. Well, no, I haven’t. I quickly look at my account on my phone app. I tell them there’s no such activity on my account. They say it just happened a few minutes ago and they haven’t processed it and won’t unless I say it’s ok. So, they’re going to cancel my card and reissue a new one. It’ll be arriving in a few days. I test them. I say, “Which card, I have a couple?” They proceed to tell me the first eight digits of the card. Dang, that’s good. To summarize, they know my name, my bank, where I might shop, what kind of card I have, and the first eight digits of the card. I’ve told them nothing. And now….the fishing expedition. Before we can cancel the card, they say, we need your pin number for security purposes. Ahhh, there it is! My bank would only ask for my pin if I called THEM. I say no, my bank would never ask for that. He gets mad, starts making threats. The second time they called, they asked for the last eight digits of the card. They already know the first eight. So now I know, they have an old card number. The first eight numbers always stay the same, but my last eight change whenever a new card is issued. That’s what they’re looking for.

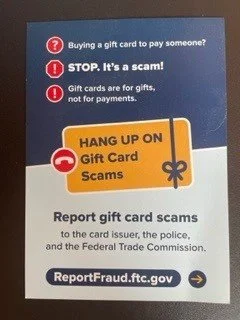

It’s a really good scam. It’s convincing until the point that they ask for info. They know a lot of info already. They keep trying, subtly changing their tactic with each call. Don’t fall for it. Hang up and call the fraud department of your bank directly. Or do what I did. Drag them along for a while until they realize that you’re on to them. Then they’ll reveal themselves in a fit. The last time they called I told them they should really move on because they’re not going to get anything from me, and I just let them talk to waste their time. They’ve since lost my number.